Revolutionizing Digital Transactions in India: Understanding NEFT, RTGS, IMPS, & UPI

Revolutionizing Digital Transactions in India: Understanding NEFT, RTGS, IMPS, & UPI

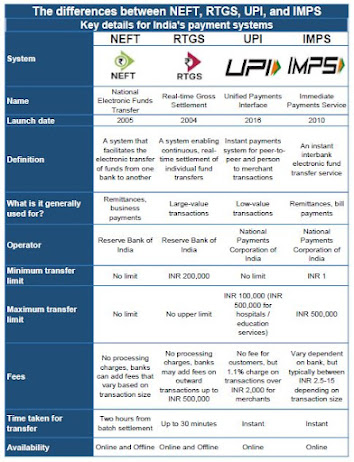

In today's digital age, India is witnessing a monumental shift towards cashless transactions, with digital payment systems playing a pivotal role in driving financial inclusion and convenience. Let's delve into the intricacies of some key digital payment systems and understand the differences between NEFT, RTGS, IMPS, and UPI:

1. NEFT (National Electronic Funds Transfer):

- 🔄 NEFT facilitates one-to-one funds transfer from one bank account to another.

- ⏰ Transactions in NEFT are settled in batches and are processed in hourly intervals during working hours.

- 💸 NEFT is suitable for low to medium-value transactions and is widely used for various purposes like salary credits, bill payments, and more.

2. RTGS (Real-Time Gross Settlement):

- ⚡ RTGS enables real-time settlement of large-value transactions.

- 🏦 Transactions in RTGS are processed individually, and funds are settled in real-time, providing instant transfer of funds.

- 💼 RTGS is primarily used for high-value transactions such as large business payments, investments, and interbank transfers.

3. UPI (Unified Payments Interface):

- 🤝 UPI revolutionized digital payments with its interoperable and user-friendly interface.

- 📲 UPI allows users to link multiple bank accounts to a single mobile app and facilitates seamless fund transfers in real-time.

- 🛒 UPI is extensively used for merchant payments, utility bill payments, and even for making investments in mutual funds and stocks.

- 📱 IMPS allows instant transfer of funds 24/7, including weekends and holidays.

- 🚀 IMPS utilizes mobile banking channels, enabling users to send and receive money instantly using mobile phones.

- 🌐 IMPS is highly convenient and is widely used for peer-to-peer transactions, bill payments, and online shopping.

India's digital payment ecosystem has evolved significantly, offering users a plethora of options for seamless and secure transactions. Understanding the nuances of NEFT, RTGS, IMPS, and UPI empowers individuals and businesses to choose the most suitable payment mode for their specific needs. As the country continues its journey towards a cashless economy, these digital payment systems will play an increasingly integral role in shaping the future of financial transactions. Embrace the digital revolution, and leverage these innovative payment solutions for a hassle-free banking experience! 🚀💳

Comments

Post a Comment